by Charles Katebi

Every 8 weeks, Paula Bennet visits a primary care clinic to receive Remicaid infusions to treat her Crohn's disease. Normally, an appointment like this would cost $30 in copays. But in Paula's case, her health plan pays her.

That's because her employer, Health Trust, works with a company called Vitols SmartShopper that rewards workers in cash when they choose a lower cost provider. Paula used to go to an expensive hospital located near her house that charged $40,000 for infusions. That all changed when SmartShopper offered financial incentives to instead go to a primary care clinic that charged only $4,000.

"I get $500 for the Remicaid Infusion when I go in [the clinic] for the treatment," Paula said. "They pay me because the savings is that substantial to the insurance company."

She's right. Within the first year of HealthTrust's partnership with SmartShopper, the company saved $1.5 million by allowing patients to shop for healthcare like they would for anything else.

SmartShopper developed an online platform that lets patients compare prices for treatments across providers in their network. It also lets patients compare the quality of providers through patient reviews, government data, and other quality metrics.

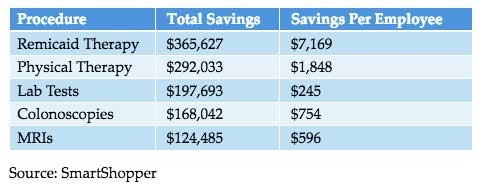

SmartShopper then offers patients cash rewards when they choose a lower cost provider. The larger the savings, the larger the reward. Patients seeking a blood test could get $25 for picking a discount lab. At the same time, patients looking for a knee replacement could receive up to $500.

The Smart Shopper program is one of many new innovative ways employers, particularly state and local employers, are trying to address rising healthcare care costs. According to a new Kaiser Health Benefits Survey, the average annual premium workers pay for family coverage increased from $2,937 to $5,227 over the last ten years. Meanwhile, the average employer's share of annual health premiums increased 51% from $8,508 to $12,865.

Until recently, New Hampshire's state employee health plan was on a similarly unsustainable path. Then the Granite State partnered with Smart Shopper to incentivize state employees to find affordable healthcare services. Within three years, Smart Shopper saved taxpayers $12 million and paid state employees $1 million in cash rewards.

Wyoming is in desperate need of similar reforms. Since 1999, state spending on employee healthcare grew from $37 million to $244 million, an increase of 546%. The average annual premium for a family plan now costs $23,361.

Like in other states, Wyoming's public employees have little reason to care how much their healthcare costs. Nearly 60 percent of all workers pay a mere $350 in deductibles, and another 27 percent pay just $750. As soon as they pay their deductible, they don't care if their doctor charges the state insurer $500 or $5,000 for an MRI.

Because Cowboy States employees pay so little out-of-pocket, they hardly ever shop for healthcare on price. That's a huge problem. According to the healthcare transparency startup, Amino.com, the cost of medical treatments can vary by thousands by dollars depending on which hospital you visit. For example, a visit to a hospital in Cheyenne for ACL surgery will cost $9,933 on average. But if you decide to have your surgery in Casper, it'll cost $18,387. That's real money out of taxpayers' pockets.

Around the country, Smart Shopper and other public employee health reforms are delivering real taxpayers savings and putting patients in control of their healthcare. It's time we put them to work in Wyoming.