by Philip Baron

According to a Wyoming Taxpayers Association report, that was distributed to the legislators in the 2019 session, a three-person household pays in $3,070 in taxes and receives $27,600 in public services. This analysis only considers taxes as a source of revenue and does not look at all of the funding through fees and other sources of state and local revenue that pay for public services.

The rest of the state's revenue to pay for those services comes from personal taxes paid to the state and local governments, federal income tax (both corporate and personal), other state and federal taxes paid by businesses, fees that are collected by the state and other revenue generated by state agencies and local governments.

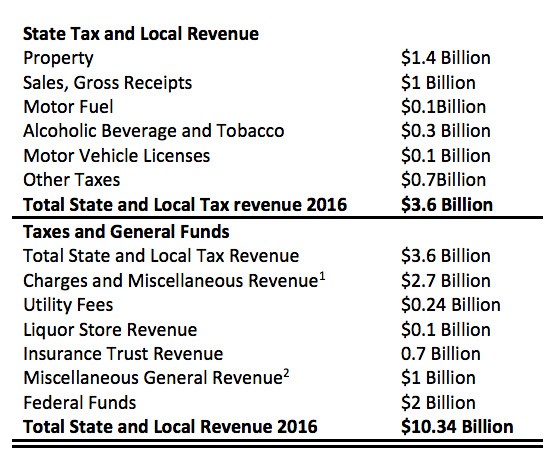

In 2016, according to data from the U.S Census Bureau using data for combined state and local revenue:

- Wyoming had $10.34 Billion in state and local Revenue.

- Wyoming spent about $10 Billion that year on state and local government.

- $3.6 Billion of revenue was from state and local taxes on both individuals and businesses

- $4.74 Billion of the revenue was from fees, investment revenue and insurance trust revenue and other state and local revenue.

- $2 billion was from federal funds returned to the state and local governments (this money originated as personal and corporate income taxes)

This is a breakdown of where that money comes from.

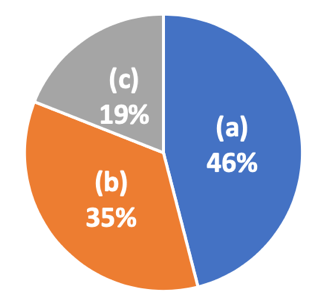

Percent of Wyoming Revenue Sources

- a. 46% Fees and Investments and other revenue sources

- b. 35% State and Local taxes

- c. 19% Federal funds

1 Per U.S Census Bureau report: Charges (fees) on Education, Hospitals, Highways, Airports, Natural resources, Parks and recreation, Sewerage, Solid waste management and other charges.

2 Per U.S Census Bureau report : Interest earnings, Special assessments, Sale of property, Other general revenue.