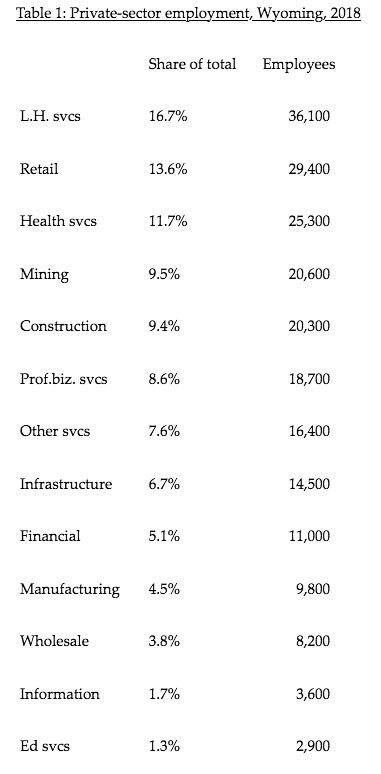

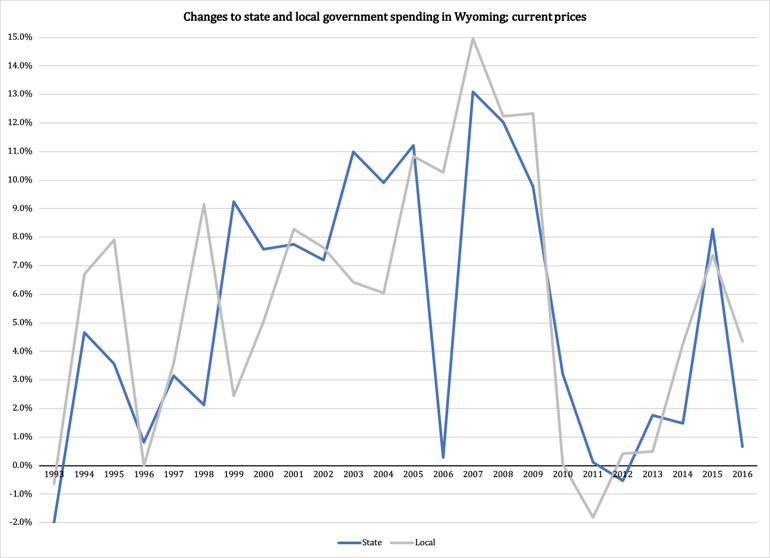

by Wyoming Liberty Group Staff With reference to the recent job losses in Wyoming coal mines, this Report presents a review of employment trends in the private sector since 1990. Main findings: 1) Job growth today is low by historic comparison. 2) In terms of employment, our economy is more diversified now than it was three decades ago. News storie...

Mailing Address: 1740 H Dell Range Blvd. #274

Cheyenne WY 82009

Phone: (307) 632-7020